In the AVM world, there is a bit of confusion about what exactly is a “cascade.” It’s time to clear that up. Over the years, the terms “cascade” and “Model Preference Table®” have been used interchangeably, but at AVMetrics, we draw an important distinction that the industry would do well to adopt as a standard.

In the beginning, as AVM users contemplated which of several available models to use, they hit on the idea of starting with the preferred model, and if it failed to return a result, trying a second model, and then a third, etc. This rather obvious sequential logic required a ranking, which was available from testing, and was designed to avoid “value shopping.”[1] More sophisticated users ranked AVMs across many different niches, starting with geographical regions, typically counties. Using a table, models were ranked across all regions, providing the necessary tool to allow a progression from primary AVM to secondary AVM and so on.

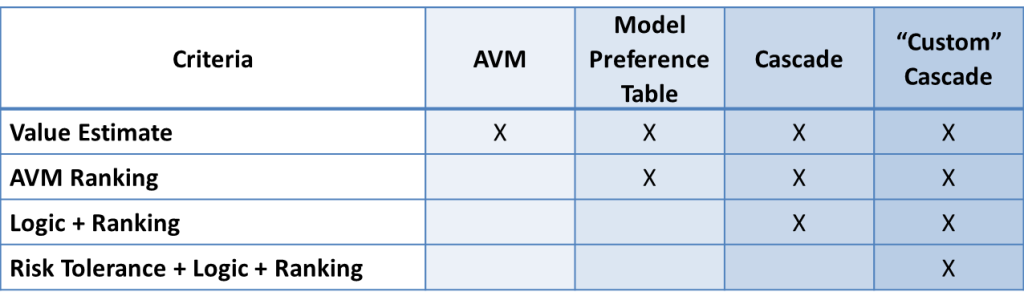

We use the term “Model Preference Table” for this straightforward ranking of AVMs, which can actually be fairly sophisticated if they are ranked within niches that include geography, property type and price range.

More sophisticated users realized that just because a model returned a value does not mean that they should use it. Models typically deliver some form of confidence in the estimate, either in the form of a confidence score, reliability grade, a “forecasted standard deviation” (FSD) or similar measure derived through testing processes. Based on these self-measuring outputs from the model, an AVM result can be accepted or rejected (based on testing results) in favor of the next AVM in the Model Preference Table. This application reflects the merger of MPT rankings with decision logic, which in our terminology makes it a “cascade.”

| Criteria | AVM | MPT® | Cascade | “Custom” Cascade |

| Value Estimate | X | X | X | X |

| AVM Ranking | X | X | X | |

| Logic + Ranking | X | X | ||

| Risk Tolerance + Logic + Ranking | X |

The final nuance is between a simple cascade and a “custom” cascade. The former simply sets across-the-board risk/confidence limits and rejects value estimates when they fail to meet the standard. For example, the builder of a simple cascade could choose to reject any value estimate with an FSD > 25%. A “custom cascade” integrates the risk tolerances of the organization into the decision logic. That might include lower FSD limits in certain regions or above certain property values, or it might reflect changing appetites for risk based on the application, e.g., HELOC lending decisions vs portfolio marketing applications.

We think that these terms represent significant differences that shouldn’t be ignored or conflated when discussing the application of AVMs.

Lee Kennedy, principal and founder of AVMetrics in 2005, has specialized in collateral valuation, AVM testing and related regulation for over three decades. Over the years, AVMetrics has guided companies through regulatory challenges, helped them meet their AVM validation requirements, and commented on pending regulations. Lee is an author, speaker and expert witness on the testing and use of AVMs. Lee’s conviction is that independent, rigorous validation is the healthiest way to ensure that models serve their business purposes.

[1] OCC 2005-22 (and the 2010 Interagency Appraisal and Evaluation Guidelines) warn against “value shopping” by advising, “If several different valuation tools or AVMs are used for the same property, the institution should adhere to a policy for selecting the most reliable method, rather than the highest value.”