Appraisals are the gold standard when it comes to valuing residential real estate, but they aren’t always necessary. They’re expensive and time-consuming, and in the era of COVID-19, they’re inconvenient. What’s the alternative?

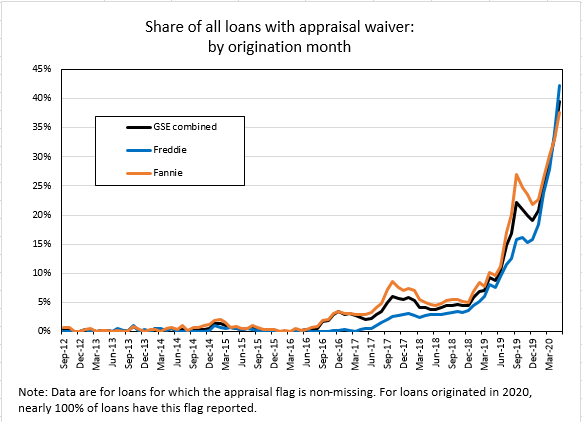

Well, Fannie and Freddie implemented a “Property Inspection Waiver” (PIW) alternative more than a decade ago. However, it’s been slow to catch on.

But now, maybe the tipping point has arrived during the pandemic. Recently published data by Fannie and Freddie show approximately 33% of properties were valued without a traditional appraisal! (Most, if not all, would have used an AVM as part of the appraisal waiver process.) Ed Pinto at AEI’s Housing Center calls it a hockey stick.

So, what changed? Here are some thoughts and hypotheses:

- Guidelines changed a little. We can see in the data that Freddie did almost zero PIWs on cash out loans, but in May that changed, and at lease for LTVS below 70%, they did almost 15,000 cash out loans with no appraisal.

- AVMs changed. Back when PIWs were introduced, AVMs operated in a +/- 10% paradigm. They were more concerned with hit rates than anything else, and they worked best on track homes. But, today they are operating in a +/- 4% world, hit rates are great, and cascades allow lenders to pick the AVM that’s most accurate for the application.

- Borrowers changed. These days, borrowers have grown up with online tools that give them answers. They are more likely to read about their symptoms on WebMD before going to the doctor, and they are more likely to look their home up on Zillow before calling their realtor. In the past, if home was purchased with a low LTV, who was it that required an appraisal? Typically, it was borrowers that wanted the appraisal – more as a safety blanket than anything else. They wanted reassurance that they were not getting ripped off. Today, for some people, Zillow can provide that reassurance without the $500 expense.

- Lenders changed. You would think that they are nimble and adaptable to new opportunities. But where the rubber meets the road, it’s still people talking to customers, and underwriters signing off on loans. If loan officers aren’t aware of the guidelines, they’ll just order an appraisal. Often ordering an appraisal, because it can take so long, is just about one of the first things done in the process, regardless of whether it’s necessary. After all, it’s usually necessary, and it takes SO long (relatively speaking, of course). I have known lenders who required their loan officers to collect money for an appraisal to demonstrate customer commitment. But, lenders are starting to incorporate PIWs into their processes and take advantage of those opportunities to present a loan option with $500 less in costs.

Accurate AVMs are a necessary but not sufficient criteria for PIWs, and now that AVMs are much more accurate, PIWs are much more practical, and we’re seeing much higher adoption.

So now what should we expect going forward? The trend will likely continue. There’s a lot of room left in some of those categories for PIWs to grab a larger share.

If agencies are doing it, everyone else will. If there are lenders not using PIWs to the extent possible, they are going to be at a disadvantage.